2022년 9월 25일. 스위스 연금 개혁안 투표 이유는 정부의 '재정' 안정을 도모하기 위함임.

연금 지불량은 줄이고, 부가가치세를 증가시켜 '재원'을 확보하기 위함임.

연금개혁안과 부가가치세 증세는 서로연결되어 있어 국민투표에 동시에 부침.

투표 찬반 내용은?

(1) 연금 개혁안 내용 - 퇴직 연령 65세가 남녀 모두에게 적용. 여성 퇴직 연령은 64세에서 65세로 상향조정.

(2) 부가 가치세 (VAT) 2.5%에서 2.6%로 상향 조정안. 표준율은 7.7%에서 8.1%로 상향.

투표 결과는 아슬아슬하게 찬성 통과.

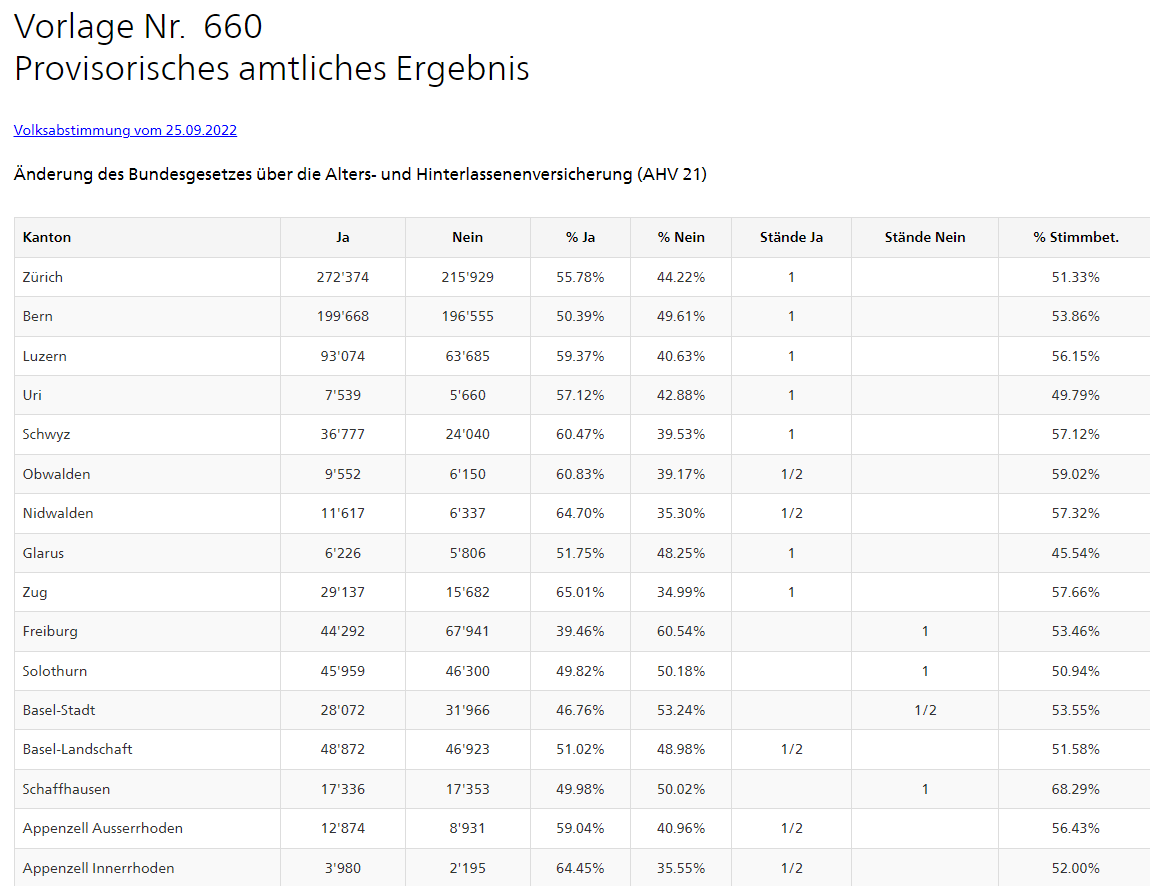

스위스 프랑스어 사용권은 정부 연금 개혁안 반대, 독일어 사용권은 찬성하는 가운데, 전체 투표 50.57%로 연금 개혁안 통과. 부가가치세 증세는 55.05%로 찬성.

제네바 (Geneva: Genf) 62.76% , 프랑스어권 '프리부 Freibourg' 에서 60.54%, 북서쪽 쥐라 (Jura) 주는 70.88%가 연금개혁안 반대함.

쭈리히(Zürich)는 55.78%, 니트발덴 64.70%가 찬성함.

국민투표 이유. 베이비 부머 세대 퇴직 증가, 수명 연장으로 현재 정부 연금 부족 상황 초래 염려.

(1) 연금 개혁안 내용 - 퇴직 연령 65세가 남녀 모두에게 적용. 여성 퇴직 연령은 64세에서 65세로 상향조정.

(2) 부가 가치세 (VAT) 2.5%에서 2.6%로 상향 조정안. 표준율은 7.7%에서 8.1%로 상향.

선택권 부여. 63세에서 70세 사이에 은퇴를 선택할 수 있음. 이 나이 구간에서 노동시간을 점진적으로 축소하면서 '부분 연금'을 신청할 수 있고, 노동 동기 부여도 가능함.

OASI reform

On the 25 September 2022 the Swiss electorate voted on the Supplementary financing of OASI by increasing Value Added Tax and amending the Federal Act on Old-Age and Survivors' Insurance (OASIA) (OASI 21).

Results: Supplementary financing of OASI by increasing Value Added Tax

Results: Federal Act on Old-Age and Survivors' Insurance (OASIA) (OASI 21)

Summary

Two proposals - one reform

The OASI reform comprises two proposals.

The first would increase VAT in order to fund OASI. This increase is a constitutional amendment that is subject to a mandatory vote.

The second proposal would make changes to OASI benefits.

A referendum against these changes has been demanded. The two proposals are linked to each other; if either is rejected, the entire reform process fails.

Current situation

The financial stability of OASI is at risk because baby boomers are reaching retirement age and life expectancy is rising. In a few years, OASI's revenue will no longer be sufficient to finance all its pension payments.

The proposals

The reform to stabilise OASI (OASI 21) is intended to guarantee OASI pensions for the next ten years or so. It provides for both savings and additional revenue.

A uniform retirement age of 65 will now apply for both women and men. The retirement age for women will be gradually increased from 64 to 65.

This increase will be cushioned by taking compensatory measures: If the reform comes into force as planned in 2024, women born between 1961 and 1969 will be able to retire early under better conditions or receive a higher OASI pension if they work until they are 65.

Additional revenue will come from an increase in VAT: the reduced tax rate will be increased from 2.5 to 2.6 per cent, the standard rate from 7.7 to 8.1 per cent. The reform also brings more flexibility: People will be free to choose a transition to retirement between 63 and 70 and to gradually reduce working hours while claiming a partial pension. Those who work after the age of 65 may now in certain cases close contribution gaps and thereby increase their pension. This creates an incentive to work for longer.

Swiss vote results on pension reform, taxes and factory farming

25/09/2022 BY LE NEWS

On 25 September 2022, Swiss voters voted on four federal initiatives on whether to reform the state pension system, remove some withholding taxes and stamp duty and whether to restrict factory farming.

© Bizoon | Dreamstime.com

Voting this weekend saw two initiatives accepted and two rejected. Majorities were in favour of the government’s pension reform plan (50.57%) and raising VAT to improve pension finances (55.07%).

However, tighter restrictions on factory farming (62.86%) and changes to withholding tax and stamp duty (52.01%) were rejected by voters.

The votes showed notable differences between French- and German-speaking voters, a linguistic divide known as the Rösti Graben (rösti is a grated potato dish associated with Switzerland’s German speakers and Graben means ditch or trench).

A majority of German speakers were in favour of the government’s plan to reform pensions, while a majority of French speakers were against it.

The difference can be seen visually on a map put together by RTS. Similar differences were visible on the plan to cut withholding tax and stamp duty, with German speakers in and around Basel and Italian speakers joining French-speakers in opposition – see map here.

The initiative to restrict factory farming was rejected by every canton except Basel-City. At a municipal level it found majorities in Central Geneva, Lausanne, Bern, Luzern, Zurich, Winterthur and a number of other urban municipalities.

https://lenews.ch/2022/09/25/swiss-vote-results-on-pension-reform-taxes-and-factory-farming/

'정책비교 > 국제정치' 카테고리의 다른 글

| 코카인과 벨기에. 100톤 코카인, 벨기에 안트베르펜에 수입. (0) | 2023.01.12 |

|---|---|

| 브라질 볼소나로 지지자들, 폭력 난동. 룰라 대선 승리 불인정. (0) | 2023.01.09 |

| 미국 경제 정책이 낳는 폐해들. 경제난 지표들 2022.2023 (0) | 2023.01.03 |

| 스위스 언어 지도와 '언어 평화' 유지되나? 독일어 72%, 프랑스어 21%, 이탈리아어 6.5%, 로마니쉬 0.5%. 스위스 국가의 언어는 '화해'다. (0) | 2022.12.24 |

| 엘론 머스크, 트위터 여론조사 실시 중. "트위터 대표직을 사임해야 하나요? 나는 여론조사 결과를 따를 것입니다." 현재 사임 찬성 55.2%, 반대 44.8% (0) | 2022.12.19 |

| EU, 미국 , UK 중앙은행 금리 변화. GDP 대비 정부 부채율 변화. 2010년 ~2022 (0) | 2022.12.14 |

| 독일 노인 인구 증가. 독일인 평균 수명 증가. 2070년 여자 90.1세, 남자 86.4 (0) | 2022.12.03 |